Here is a simple underwriting tip!

Economic Vacancy, its practical use.

A new Apartment Syndicator calls us up and gleefully tells us about this awesome deal he found! It is a 100-unit apartment that is 100% occupied, or put another way, has a vacancy rate of 0%.

Sounds awesome!

But there is always more to the story.

Delinquent rent:

- Frank only paid 50% of his rent. He has been laid off. But his unit is occupied!

- Sally paid did better; she was able to pay 75% of her rent. But her unit is occupied!

- Little Johnny, well… He didn’t pay any rent. But his unit is occupied!

Rent Concessions:

- Twelve retired people on fixed income are receiving a 10% discount. But those 12 units are occupied!

- Mike got the first month rent free at move in.

Employee Allowances:

- The awesome property manager gets a free unit, but, you guessed it, her unit is occupied.

- The maintenance guy is the best. He gets 50% off – still occupied.

You get the picture. 0% vacancy, but not economically.

But Wait, it gets WORSE!

Gain/Loss to Lease:

- The business plan for the apartment syndication you are considering investing in is based on the theory that the market rent is $150 more per month than people are paying. What about all the tenants who still have 5 or 6 months left on their leases and who are not paying market rent? Gain/Loss to Lease is the term for that.

Bad Debt Write Off

- What about those tenants we evicted and were behind a few months when the judge finally approved their eviction?

Model Units

- Units that are used as model units for showings. They typically are staged with furniture.

Units Down for Remodeling

- Units are down for remodeling. Well, they aren’t listed in many T12s. Or they are grouped under “Vacancy Lost.”

A T12 is a 12-month lookback at the Profit and Loss of an apartment.

The T12s I love have a row called Gross Possible Rent or Gross Potential Rent. Some are vague and will call it Market Rental Income.

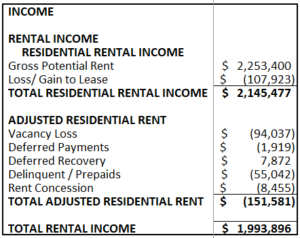

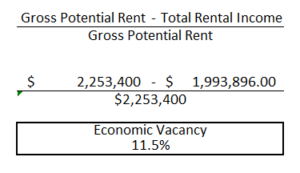

Here is an excerpt from a T12 for a 160-unit apartment in Houston, TX. This apartment required unit remodels, exterior paint, and driveway and parking lot resurfacing. A “Heavy Lift,” as the people who use buzz words would call it.

Practically Speaking

A stable, well-run 100 to 400-unit apartment typically has an 8% – 12% Economic Vacancy. Again, it depends on the market the property is located in. Dallas typically has an economic vacancy of 8% to 10%. Houston generally is 10%-12%.

If we know a stable apartment in Houston has 10 – 12% economic vacancy, we will remodel 50% of the units in 18 months. The Economic Vacancy rate must be 15% to 25%.

We know very experienced operators who remodel units and keep the Economic Vacancy at 15%. I wish we could share with you how they do it, but we pledged to them we would not.

Conversely, inexperienced, first-time syndicators seem to have 23% – 25% Economic Vacancy in the first year, and around 18% in the second year, leveling off at about 10% about eighteen months into ownership.

The difference is in the experience level. Experienced syndicators know what kitchen and bath fixtures they will use, cabinet doors, countertops, light fixtures, and flooring. They will pre-order everything and have it in stock, and other efficiencies we can not discuss.

Inexperienced will try remodeling a few units with granite countertops, tan walls, and nickel-looking fixtures. Then mix and match finishes with two more with Formica countertops, gray walls, and chrome fixtures.

They have committee meetings trying to find the best solution. It is painful for me to watch.

The key takeaway is simple. Suppose you see underwriting where the business plan for the apartment is to remodel 50% or 100% of the units, the Economic Vacancy is not displayed and you need a calculator to figure out the Economic Vacancy manually; when you do the math, the economic Vacancy is 10% every year – RUN!

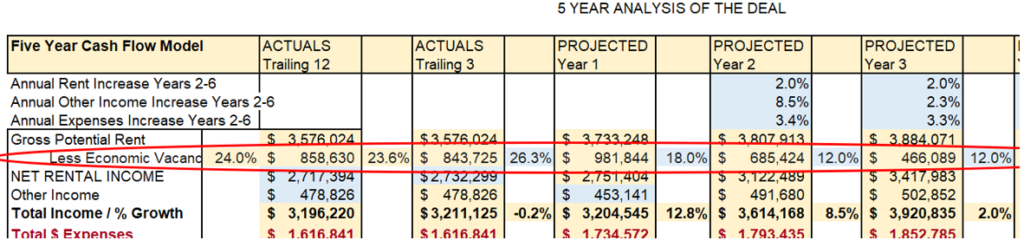

Here is an excerpt from a deal we did invest in because the underwriting was conservative. They had 26% economic vacancy the 1st year and 18% the second year.

Even though this was the General Partners’ 3rd deal, we did invest in it. We know, like, and trust the GPs; the underwriting was very conservative. This has proven to be a solid investment for us since 2019.