High net worth individuals often find passive investing in apartment syndications to be an attractive option. These investments offer the potential for a high return on investment with minimal effort. To reach these outcomes, though, it is essential to find your strike zone to identify potential investments by understanding the underwriting guidelines.

We have been investing in real estate since 2000 and have yet to lose money in a real estate investment. Our real estate returns are more or less infinite. Why? We focus only on deals that match our stringent criteria, or that are in our strike zone. To date, we have invested in 21 apartment syndications as Passive Investors, which is synonymous with being a Limited Partner, and 8 apartment syndications as a General Partner, or Deal Sponsor.

We have achieved this by only investing in properties that have the highest chance of performing well – we do not waste our time or capital looking at deals outside our stringent criteria. Life is too short!

You cannot control the crime in the neighborhood, the growth, or lack thereof, the rate of job and wage growth, the city council, the mayor, the county, the governor, the flood zone, etc. With this in mind, here is the criteria that brings us success, in order of importance:

- Landlord and business friendly municipalities.

- The city, county, and state.

- Located outside of a flood zone.

- Kids can walk to top-rated schools.

- Located in a few specific cities, within specific neighborhoods in those cities.

- Close to the hospital—medical professionals rarely, if ever, get downsized or laid off.

- Not located across the demarcation line, or “across the railroad tracks.”

- Has a longer term, 7–10-year hold.

The building should be either:

- Ground up new construction

We develop the land and hold the property for one economic cycle, about ten years. Our build-to-rent townhomes often had around 50% equity at the end of construction.

Or

- Meet a specific building type

We look for a garden style building, built in the mid 1980’s or newer. Class B or in some cases Class A. It should have units that haven’t been remodeled and property management that lacks the ability to manage the property well.

Let’s take a closer look at some of these points in detail.

Landlord and Business Friendly Municipalities

We watched the city of Seattle erode the landlord tenant laws and punish businesses for being very successful. We don’t want to invest in like-minded city, county, or states.

Amazon’s corporate headquarters has been practically driven out of Seattle and is now quietly moving most new hires over to Bellevue, WA, a conservative island, in a sea of progressives. Much the opposite of Austin, TX, an island of progressives in a sea of conservatives. We personally don’t invest in progressive or “woke” areas.

To expand further, in Seattle, the first “qualified applicant” who completes a tenant application automatically secures the rental. Past and/or current criminal behavior is not a reason for denial. Landlords cannot use social security numbers to run background checks.

We want to choose who our tenants are to ensure they are a good fit and vibe with other residents in a complex. This is why we have sold all but one property in the state of Washington, and the other will be put on the market soon.

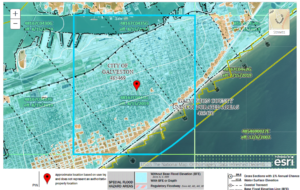

FEMA Flood Maps

It is essential to review FEMA flood maps before investing to ensure that the property is not at risk for flooding. Knowing the flood zone of a property can help you decide whether it is a viable option for investment. It is essential to review the FEMA Flood Maps to ensure the property isn’t at risk for flooding.

You MUST click on the map and zoom in. I start by zooming in ALL the way and going to get a cup of coffee while the map loads. Remember, it is a government created website processing a large amount of data. IT. IS. SLOW.

When looking at a FEMA flood map, blue shaded areas have a 1% chance of flooding annually. Insurance considers this a flood zone. An area with a 2% chance of flooding is tan in color.

To give it a try, enter Galveston, TX in the FEMA Flood Map search. To get the FEMA flood map to display any data, your need to zoom in to a neighborhood or street level and wait a little bit. The maps process a lot of data and are slow.

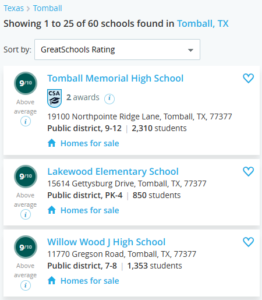

A Grade Schools

Some ask why we only invest in apartment syndications in areas with high quality schools. The answer is simple. Quality schools often mean parents are involved in their children’s education. Parents interested in their kid’s education are responsible parents.

Responsible people pay rent. Responsible people care about the community they live in. Responsible people typically do not trash the units. Responsible people don’t throw their trash out in the parking lot. Get the idea?

I included the screenshot from GreatSchools.org showing Tomball, TX, where we are General Partners in a 206-unit apartment building constructed in the 1980s. Tomball is in the Houston School District. You can clearly see that Tomball High School ranks 9/10 in the district.

Why Explosive Growth?

We also look for cities with current or planned rapid growth. And we mean explosive growth with various industries moving in and spending billions of dollars in manufacturing plants or millions of square-feet of office/warehousing/or flex parks. All this drives economic and population growth.

For example, we did an internet search for news about planned developments in Tomball, TX. We used searches like “new business parks, Tomball, TX” or “massive expansion Tomball, TX.” After digging around, we discovered plans to build a new Costco, a new 3.3 million square-foot office park, and 2 additional office parks of approximately 1 million square-feet each. What we found is that, when added together, Tomball, a town of 12,500 people on the edge of Houston, is developing over 5 million square feet of “Flex Space!”

Flex Space is modern version of an Office Park. Most Flex Spaces allow light industrial, warehousing, and offices. Typically, large warehouses are built with store fronts and entrances. The spaces are also easily changed to fit each tenant. For instance, if the tenant leasing 30,000 square-feet moves out, new walls can be placed inside, and two 15,000 square-foot spaces are created. There is obviously immense growth planned for this area, which also means? You got it. More tenants!

Why Near Hospitals?

The reason we were looking into Tomball was our great relationship with Clayton Bownds, who had a deal under contract in the area. The more we researched Tomball, the more we loved it. And the apartments Clayton found happened to be 1,000 feet from HCA Houston Hospital.

The reason we love to invest near hospitals is simple. Medical professionals make stable tenants. They typically move in after college, keep their credit score clean, save money, and eventually go purchase a house. In the meantime, they pay their rent-on time. In my mind, that is the dream tenant – a person with goals, and desiring a better life.

Why We Avoid “The Wrong Side of the Tracks?”

Think of the town you grew up in. There was probably the “nice neighborhood”, then the proverbial “train track”, or street. On one side of the street, it’s all roses and flower beds. On the other side is nothing but broken-down cars and refuse in the front yard. A thousand feet matters a great deal in many locations.

You could use CityData.com to get a rough idea. But you’re really need to walk around an area to get a true feeling for how rough a neighborhood is. If you feel you need a flack-jacket to walk down the street, why on earth would you want to own an investment there?

Some people, say, I only own where I want to stay. When I was in my 20s, I would have loved living in some of the apartments we own. Now? Grade A all the way! However, we love Class B apartments. Correction, we love investing in Class B apartments!

Why 7-10 Year Holds

With passive investing in apartment syndications, we are seeking long-term stable cash flow. 7–10-year holds will bring stable, profitable investments. Take for example a 1990s property that hasn’t been remodeled since it was built. We can rehab all the units, freshen up the exterior, refinance the property during the second year of ownership, take 70-80% of the investment out as debt, and re-investing those funds into another property, rinse, and repeat, and repeat. Within 10-years you can have 2-3 properties with infinite returns and stable cash flow.

The Property

There is a term in all real estate – Functionally Obsolete. The concept is simple, we can exaggerate that a concrete apartment building built in 1950 with tiny windows, electric baseboard heat, one bedroom, a 2-square-foot closet, a tiny kitchen with a 24”-wide fridge, and no room for a TV in the living room—because there were no TV’s back then, is functionally obsolete.

What about 1970’s construction? I still feel like it is too functionally obsolete. Just like in 10 years 1980’s properties will be functionally obsolete. In many cases, it is not economically feasible to bring older buildings up to modern standards. Load bearing walls need to be moved, new concrete footings need to be poured….it is expensive and time-consuming. I would prefer others people enjoy the pain and suffering of figuring all that out.

Not Remodeled Since New

In a property that hasn’t been remodeled, no one has gone in and messed anything up yet. That means we have a blank slate to make the units desirable, without spending a lot of money. We can install new modern-looking cabinet doors, replace the Formica countertops with granite in the kitchen and bath, and install virtually indestructible, yet natural looking Luxury Vinyl Plank (LVP) flooring.

You have the chance to do simple, clean remodels and provide units with modern features like dimmable LED lights, new chrome or brushed nickel faucets, doorknobs and hinges, and ceiling fans that aren’t sagging.

With simple math, if you can increase rent $150 on 100 units by making improvements, a property will earn $15,000 more per month. That means $180,000 in 12 months.

If you take $180,000 divided by the market caprate of a conservative number like 5.5%, there is a $3,272,727 increase in value. At a 5.0% cap rate an additional value of $3.6 million, or $36,000 per unit!

It is low hanging fruit and easy to do. There are contractors who specialize in apartment remodels for around $6,000 per unit. Once remodeled it is easier to increase the rent, resulting in a significant increase in apartment value.

In some sub-markets there is a high demand for luxury rentals and Class A properties. In these cases, it might take an investment of up to $15,000 per unit. This means fancy fixtures and smart home systems with high-tech locks, thermostats, and lights. But the return on investment is also higher.

Most improvements are inexpensive but make a big impact on potential tenants and the rents they are willing to pay.

Exterior Improvements

Single-family homes aren’t the only real estate that need curb appeal. Making exterior improvements can have as much impact as renovations in the units. Some examples include:

- Re-surfacing the parking area

- Painting parking stripes and fire lanes with vibrant paint

- Offering reserved parking

- Adding Car ports

- Improve external lighting

- Adding inviting landscaping

Laundry

Laundry can have a big impact on the rent tenants are willing to pay. If you can, installing washers and dryers in each unit is the most desirable. You can even charge $50 a month to lease them. If that isn’t an option, updating the laundry rooms with new flooring, fresh paint, better exhaust fans, vending machines for soap and dryer sheets, can all be done at a fair price.

Hi-tech Fees

Today, everything is high tech. It is a high-value item for a lot of tenants, and they are willing to pay for it. Consider having a hi-tech fee that includes items like high-speed internet, cable tv packages, electronic/keyless locks, or smart thermostats. Adding or improving this infrastructure will attract higher quality tenants. With a large enough property, you can even look at adding a local cell tower.

Energy Efficiency and Utility Costs

Much like technology, tenants are concerned with energy efficiency and utility costs. There are several ways to address this with property improvements. For example, you can add energy efficient lights in units, implement water conservation, or offer a Ratio Utility Billing System (RUBS).

- Energy Efficient Lighting in Units

- Water Conservation

- RUBS (Ratio Utility Billing System)

Add Amenities

Amenities attract stable families and tenants which in turn improves community health and the sense of community among residents. Some examples include adding storage units, vending machines or even private yards or patios, if possible. Additional ideas include:

- Pet amenities like a dog park. By fencing in an area and adding a fake fire hydrant and a small jungle gym for dogs you can say the building offers a dog park. For the convenience, you can charge $20 per pet. $20 x 25 pet owners x 12 months = $6,000 annually. Divided by a 5% capitalization rate = $120,000 increase in value. Not bad!

- Children’s activities like a playground. This goes back to attracting quality family tenants. Families with children will pay a premium to have these facilities right outside their door.

- Resort-like amenities. While more costly, updating the fitness center, or adding a small one in an unused space, can have a large impact. The pool should also be sparkling clean, and adding items like outdoor BBQs add appeal. If there is a club house, offering clubhouse rentals can bring in additional revenue.

Many of these improvements are easy to do, buy many current owners do not see the value in spending capital on their apartments. That is where you can step in and maximize your investment in a way they haven’t been able to figure out.

Poor Property Management

We have seen all types of property management companies. Some are great companies with bad employees. Some are great employees working for an unsupportive company. Some don’t train employees on new methods, laws, or even how to use a new complicated software system. None of these make an effective combination. Can you do better? Absolutely.

I love finding an apartment in a B neighborhood with an absentee owner who just doesn’t care and a poorly run property management company. Yes, there will be 6 months to a year of hassles, like removing non-paying tenants and making repairs. But, in the end it is fairly low hanging fruit to increase the income, lower the expenses, which also increases the NOI and forces appreciation.

In Conclusion

This is just a high-altitude overview of the underwriting guidelines we use to find a strike zone and identify worthy investments.

If you think passive real estate investing might be right for you, or you would like to learn more, please join our real estate investment community! Reach out and contact us.

Most of our investments require a previous relationship with our investors. Which means we have to know each other.